Do You Send 1099 For Auto Repair

1099 Rules For Business Owners in 2022

(updated 2/9/2022)

Over the past few years, there have been a number of changes and updates regarding the reporting rules for the mysterious 1099 Forms. I say "mysterious" considering many business owners simply guess as to what the rules are and oftentimes go exasperated and just give up choosing to file cypher at all. This can be a very dangerous motion and result in penalties that tin add up very quickly.

The penalties for non filing 1099s can add up quickly and vary from $50 to $110 per Course depending on how long by the deadline the company bug them. In fact, if a business concern intentionally disregards the requirement to provide a correct payee statement, it is subject to a minimum penalty of $550 per argument, with no maximum (More on this beneath).

And then now, that I hopefully have your attention. Let me break down the basics and brand a couple of recommendations on how you tin take care of your 1099s.

The New Class and Name Changes and Deadlines

The biggest modify from last year and many don't know about it is the introduction of a new Form called 1099-NEC Non-Employee Compensation. Also, the title and purpose of Form 1099-MISC has been inverse from Miscellaneous Income to Miscellaneous Information.

- 1099-NEC. Businesses will now file Form 1099-NEC for each person in the course of the payor's business to whom they paid at least $600 during the year. This payment would accept been for services performed by a person or company who IS NOT the payor's employee. (Instructions to Form 1099-NEC)

- 1099-MISC. Other payments over $600 that a payer makes in the class of the payer's business for things such as rent, prizes, and awards, or "other income payments" are reported on Grade 1099-MISC.

The "general rule" is that business owners must issue a Grade 1099-NEC to each person to whom they accept paid at least $600 in rents, services (including parts and materials), prizes and awards, or other income payments. You don't need to issue 1099s for payment fabricated for personal purposes. You are required to upshot 1099-NEC reports only for payments you made in the course of your trade or business.

Besides, don't forget other 1099 Forms that might utilise to you equally a business owner or investor. I provided the links to the instructions for these other types of Course 1099s.

- 1099-INT. This is the tax form used to report interest income, paid past all 'payers' of involvement income to investors or private lenders at yr-terminate (1099-INT Instructions) .

- 1099-DIV. This Course is typically used by big banks and other fiscal institutions to report dividends and other distributions to taxpayers and to the IRS, If you ain and operate a C-Corporation with shareholders, this would be the Form to report payments to those investors (1099-DIV Instructions) .

- 1099-R. This Form is used to report the distributions of retirement benefits such as pensions and annuities. Also, if you lot take distributions from a self-directed IRA or 401k, you would receive some type of Grade 1099-R. (1099-R Instructions) .

Hither are the Nuts almost 1099s you should know as a Business Possessor

- Who are you required to send a Form 1099-NEC? Y'all are required to transport Form 1099-NEC to vendors or sub-contractors during the normal course of business organisation yous paid more than $600, and that includes any individual, partnership, Express Liability Company (LLC), Express Partnership (LP), or Estate.

- Who are considered Vendors or Sub-Contractors? Essentially, this is a person or visitor you have paid for services that aren't an employee.

If you aren't sure if your worker is an Employee or Sub-Contractor run into my article: "The Difference betwixt Sub-Contractors and Employees"

- What are the exceptions? The list is fairly lengthy, merely the near common is that you don't need to transport a 1099-NEC to:

- Vendors operating every bit S or C-Corporations (y'all'll discover their status out when you get a W-9…see beneath)

- LLCs or partnerships (ONLY if they are taxed as an S or C-Corp…again see the W-nine beneath)

- Sellers of trade, freight, storage or similar items.

- Payments of rent to or through real estate agents (typically property managers). However, go along in mind you need to upshot a 1099 to a landlord you are paying rent, unless they meet another exception.

- Don't worry nearly credit card payments and PayPal. The IRS allows taxpayers to exclude from Form 1099-NEC any payments you made by credit card, debit card, gift card, or tertiary-political party payment network such as PayPal. (These payments are being reported past the menu issuers and third-party payment networks on Course 1099-K.)

- However, Venmo is a different animal. If business owners are using Venmo to pay vendors from time to fourth dimension, they need o make certain and include these payments in their 'books' and determine if they've paid a Vendor more than $600. Venmo does not take care of the 1099 for you lot. The business owner is responsible to consequence the proper 1099 to those paid through Venmo.

- Lawyers get the short terminate of the stick. Ironically, the authorities doesn't trust that lawyers will report all of their income, so even if your lawyer is 'incorporated', y'all are nevertheless required to ship them a Course 1099 if you paid them more than than $600.

- The W-ix is your "all-time friend". Some of y'all may be frustrated that y'all don't accept the information you Demand to issue Class 1099. 1 of the smartest procedures a business possessor can implement is to request a West-9 from any vendor you expect to pay more than $600 before you pay them. Using this as a normal business practice will give you the vendor's mailing information, Tax ID number, and besides require them to betoken if they are a corporation or non (saving you lot the headache of sending them a 1099 next year). You tin can download a W-ix here.

- The procedure. Regrettably, y'all CANNOT simply go to www.irs.gov and download a bunch of 1099 Forms and send them out to your vendors earlier the deadline. The class is "pre-printed" in triplicate by the IRS. Thus, you take to order the Forms from the IRS, choice them upwards at an IRS service center, or hopefully catch them while supplies last from the post office or another outlet.

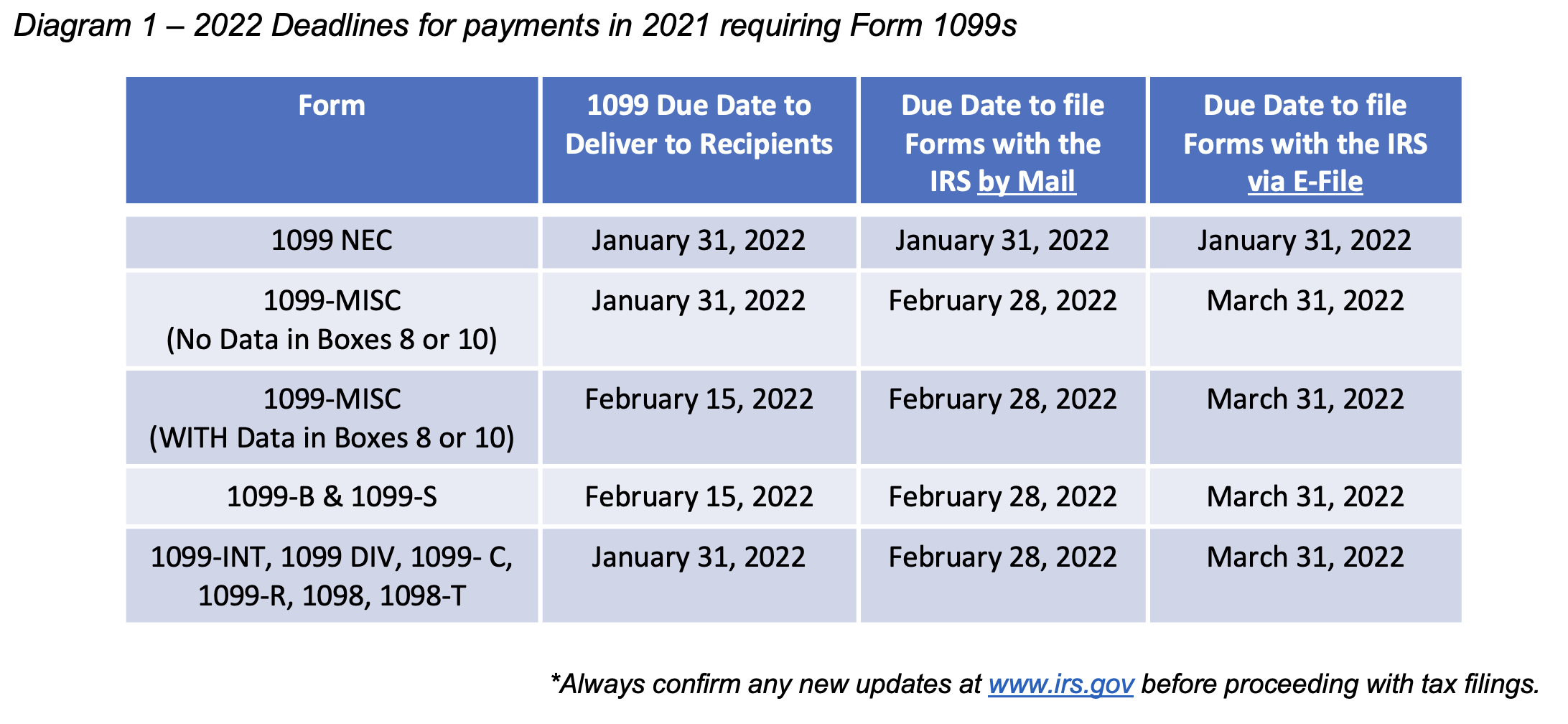

- Deadline to Payees. Taxpayers are required to result and postal service out all Forms 1099-NEC, 1099-MISC, 1099-DIV, 1099-INT, and 1099-R (to those who they paid more than $600 in 2022) past no later than January 31st.

- Borderline to Send the IRS Grade 1099-NEC …This is a new rule- Take note!! Now concern owners have to compile all of their 1099-NEC forms and send the accompanying 1096 and Postal service them to the IRS, OR file them ELECTRONICALLY with the IRS past Jan 31st besides (Non the end of February- the former rule). Also, depending on state law, you lot may also have to file the 1099-NEC with the land. Sounds like fun…correct? (This is where delegating the task to your accountant really comes in helpful).

- Deadlines to send the IRS all other Form 1099s. For Forms 1099-MISC, 1099-DIV, 1099-INT, and 1099-R, business owners have to compile all of the 1099s and Postal service them (if y'all choose to use Mail) to the IRS with a Course 1096 past February 28th. IF you desire to file ELECTRONICALLY, y'all can assemble all of the same documents and file them electronically past March 31st.

- Don't forget u.s. (sorry). And add insult to injury, there are a number of states that have filing requirements for grade 1099 and especially 1099-NEC. Currently, these states require yous to file a 1099-NEC with them – CA, DE, Hi, KS, MA, MT, NJ, OH, OK, OR, PA, RI, VT, and WI. Brand sure to ostend the rules and deadlines if y'all're operating in a Land where this is required.

- MUST I file Electronically? IF you lot have more 250 Form 1099s to file, you MUST file electronically. If y'all are required to do and then, and fail to comply, and don't have an approved waiver, yous may be bailiwick to a punishment of up to $100 per return for failure to file electronically unless you lot establish reasonable crusade. Now you can still 'choose' to file electronically if you lot have less than 250 Forms and it's easier for yous. Withal, you can file up to 250 returns on newspaper; those returns will not exist subject to a penalty for failure to file electronically.

- What nearly foreign workers? Also, if y'all rent a non-U.S. citizen who performs whatever work inside the United States, y'all would need to event them a Course 1099-NEC. If they are not a citizen AND perform all of their work outside the U.Southward., yous are non required to issue a 1099-NEC. Notwithstanding, It is your responsibility to verify that the worker (1) is indeed a non-U.S. citizen, and (2) performed all work inside or outside the United States. For that purpose, in the future you might want to have that foreign worker fill out, sign, and return to you Form W-8BEN.

Suggested Process for 2022:

Moving forward this year, make sure to get a Form W-9 from all your vendors earlier they can become paid. If they want to get paid 'under the tabular array'…tell them to motility to another land and tell yous "Thank you for paying taxes and providing roads for me and national defense!!" Getting a W-9 from them volition ensure your ultimate revenue enhancement-write off and certainly save y'all a lot of headaches side by side January so you don't take to runway down their mailing addresses or EINs. (See here the Instructions for the W-9).

What are the Penalties if I miss a Borderline?

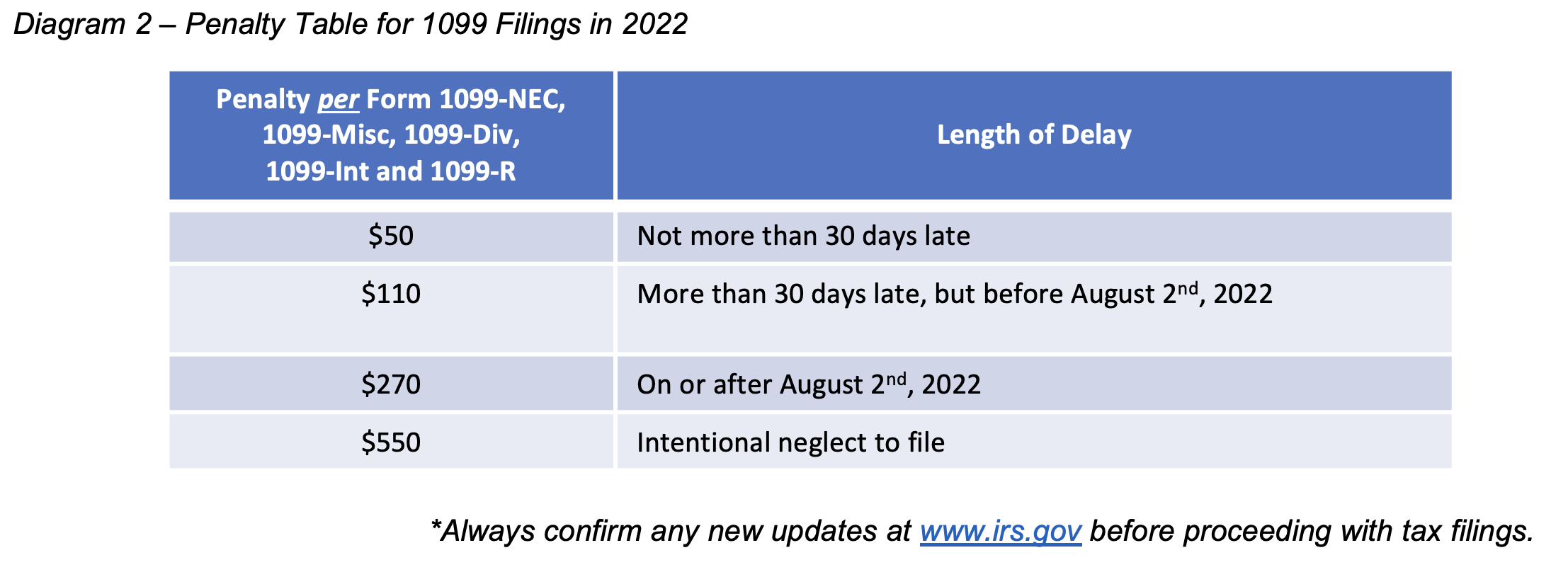

As I mentioned in a higher place, penalties for not filing a correct 1099 can add up apace and vary from $fifty to $110 per Form depending on how long past the deadline. Moreover, if the IRS can show that a concern intentionally disregarded the requirement to provide a right payee statement, they are subject to a minimum penalty of $550 per statement, with no maximum!

Don't ignore the 1099 or the process and get with your CPA to make sure to meet the appropriate deadlines. The maximum penalisation tin can easily exceed $1M for small businesses in 2022 and interest WILL be charged on those penalties. In all cases, the IRS considers y'all to be a small business concern if you've earned an average of $v one thousand thousand or less in almanac acquirement for the past 3 taxation years…AND in that location is no limit on the penalties for the intentional disregard to file (and don't recollect ignorence is a defense)!

Real-life story. I literally had a prior client contact me this past year because they chose to file their 1099s on their own and didn't carefully follow the rules. They inadvertently mailed in the forms and didn't electronically file (run across rules beneath regarding electronic filing). Effect- The IRS hit them with $17,000 in penalties and our only hope was to show reasonable cause to become them out of the punishment. ** UPDATE…months after we were able to help them go out of the penalty…but simply after a lot of fourth dimension and tears shed.

If you are already late in filing your forms …you accept a big conclusion to make (remember of "The Rock" in the movie 'The Rundown' if you oasis't seen it- a classic):

- Option (a) – Suck it up and hurry and file…Simply keep in listen, IF this is your beginning fourth dimension beingness late and yous tin show whatsoever sort of reasonable cause, the penalization could exist waived. I'm not making any promises hither…only it'due south fairly common the showtime-time offenders get more than balmy treatment….again- generally.

- Pick (b) – The IRS will make you pay. So…essentially non filing and hoping the IRS or the State doesn't audit you. Not proficient for sound sleep at nighttime and when you lot go through the pearly gates anytime.

- At that place is no Option (c) – A quote from the Movie 🙂

Finally, be careful trusting websites just to relieve simply a few dollars. Information technology can price you big time if y'all miss fifty-fifty a modest dominion or process. Well-nigh accountants accept an affordable procedure to help in the filing and can be a huge resources. Business owners need to take this filing process seriously and take personal accountability to brand sure they get completed.

Shop around, but equally you practise just know our fee at Kohler & Eyre CPAs is $50 for the 1096 and $five.00 per 1099 before January 31st and $ten.00 per 1099 after the deadline…and so it doesn't have to be that expensive. If you demand back up or have questions delight contact Maxwell Rodgers in our part for this service at 435-865-5866 or email him direct at [email protected] .

Additional Resources

* To sign up for Mark's weekly Free E-Newsletter and receive his Complimentary E-Book "The Top x Best Tax Saving Secrets Everyone Should Know" visit www.markjkohler.com.

Mark J. Kohler is a CPA, Chaser, co-host of the Podcast "Main Street Business concern Podcast" and author of the new book "The Tax and Legal Playbook- Game Changing Solutions For Your Minor Business Questions, 2nd Edition". the "8 Steps to Start and Grow Your Business Workbook", and "The Business Owner'southward Guide to Financial Freedom- What Wall Street isn't Telling You". He is also a senior partner at the constabulary business firm Kyler Kohler Ostermiller & Sorensen, LLP, and the bookkeeping firm K&E CPAs, LLP.

Source: https://markjkohler.com/1099-rules-for-business-owners/

Posted by: williamstweveseen1994.blogspot.com

0 Response to "Do You Send 1099 For Auto Repair"

Post a Comment